ERP migrations are often framed as technical upgrades. In practice, their real impact shows up in cash performance and in the organisation’s ability to keep day-to-day operations flowing. I’ve seen go-lives where minor master data inconsistencies were enough to block invoices, escalate disputes and delay payments within the first weeks. A small misalignment in SAP or any other ERP can quickly disrupt the entire Order to Cash cycle.

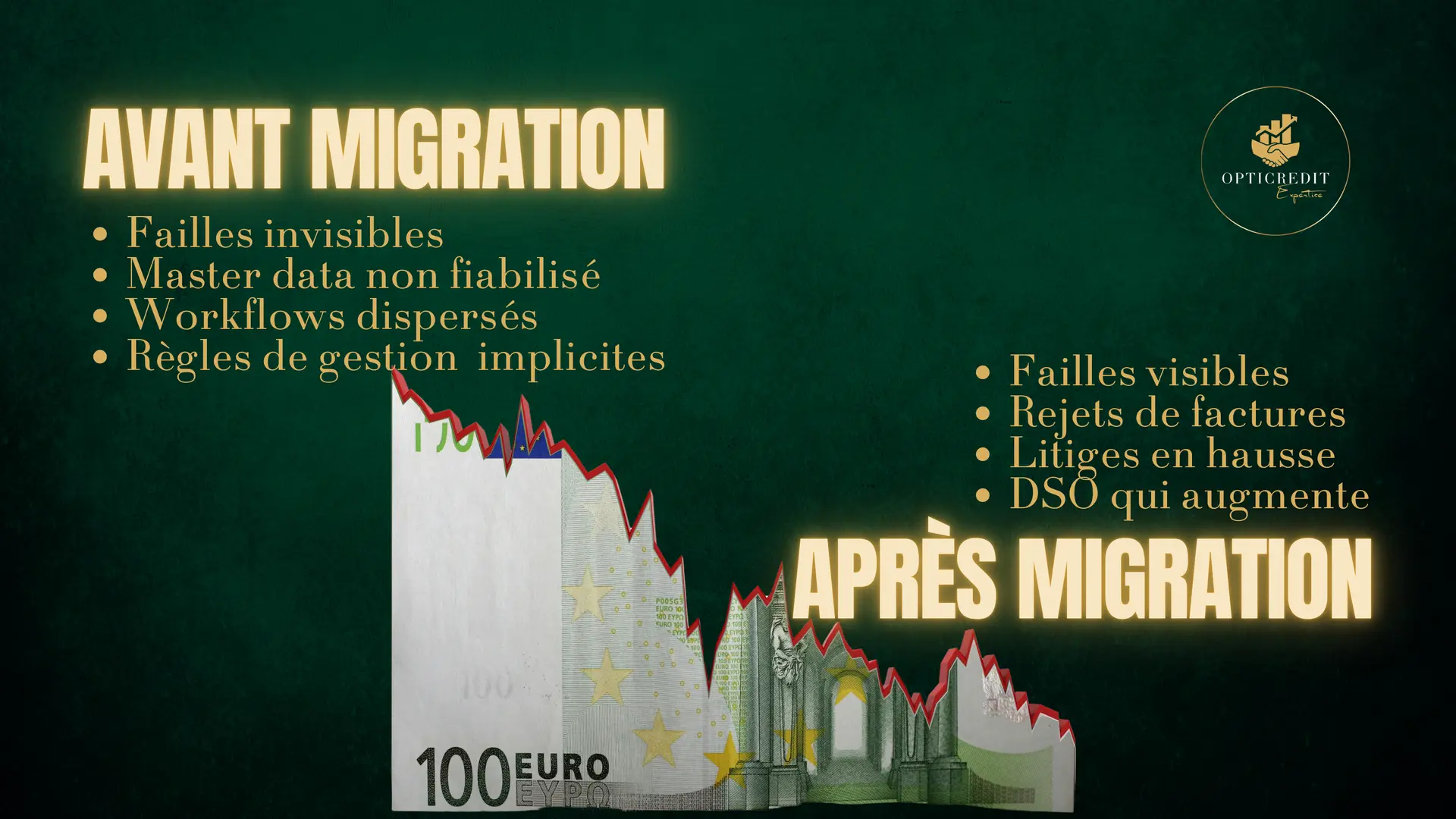

Visual summary originally designed for the French edition of this article.

The graphic below reflects the same O2C dynamics covered here.

Before migration • hidden gaps • unreliable master data • scattered workflows • implicit rules

After migration • exposed weaknesses • invoice rejections • growing disputes • rising DSO

Why ERP Migrations Pressure-Test the O2C Cycle

An ERP migration immediately exposes the quality of your rules, data and process discipline. A seemingly insignificant master data issue can trigger a spike in rejected invoices, unresolved disputes or cash visibility gaps in a matter of days. What the previous system quietly absorbed becomes visible and financially material after go-live.

When the O2C Foundation Is Weak, the Risks Multiply

A migration reveals the true state of the O2C engine. Inaccurate data, inconsistent billing rules or locally defined workflows all become sources of friction once the new system goes live. Nothing “new” appears. What used to go unnoticed becomes visible, and what was fragile becomes a bottleneck. That is usually when teams realise how exposed an under-structured O2C cycle really is.

A European Context That Underscores the Stakes

According to the latest analysis by The Hackett Group, European companies hold more than €1.4 trillion in excess working capital. A significant share comes from payment delays, unresolved disputes and invoice rejections.

A poorly prepared ERP migration amplifies these tensions and can create long-lasting pressure on cash.

The Operational Symptoms of a Poorly Managed ERP Migration

The consequences rarely start with “system errors”. They show up in daily operations:

- higher volumes of rejected invoices

- disputes increasing in both number and resolution time

- DSO deterioration in the weeks following go-live

- reduced visibility on open items and payment commitments

- poor master data quality revealed in cascade

- more IT tickets linked to O2C rules

- growing reliance on manual workarounds

All these point to the same root cause. O2C often relies on habits, undocumented exceptions and legacy configurations that lack clear governance.

The Most Common Failure Patterns

Across industries, the same issues tend to surface during migrations.

-

Unclean or incomplete master data

Outdated tax information, inconsistent payment terms, unreliable customer segmentation. - Fragmented billing rules

Discounts, taxes, surcharges or penalties configured differently across entities or regions. - Testing focused on IT rather than real cash scenarios

The day-to-day situations that actually drive collections are often insufficiently tested. - Poor alignment between finance, commercial teams and IT

Even though O2C flows run across these functions continuously.

The Critical Levers to Secure

- Stabilise and clean master data before go-live

- Define clear O2C governance and harmonise billing and credit rules

- Test real-life business scenarios, not only IT scripts

- Track cash-related metrics daily from the first week of go-live

These levers reduce immediate risks and prevent long-lasting disruptions.

What Successful Migrations Have in Common

Companies that manage their ERP transition well share the same foundations. Their customer master is clean, O2C rules are aligned, cash metrics are monitored from day one and operational teams are prepared. In those conditions, an ERP migration becomes a driver of visibility, discipline and performance.

Regaining Control of O2C to Secure the Migration

An ERP migration is not inherently risky. It becomes risky when it sits on top of an unstable O2C cycle. Conversely, a strong O2C foundation turns the transition into an opportunity. Fewer disputes, better predictability and more reliable cash performance.

Preparing the O2C cycle is not optional, it’s the prerequisite for a controlled ERP migration and resilient cash flow.